Don’t Invest ‘Just Because’, Ep 434 / Royden Shotter

Paradoxically, the pursuit of pleasure or chasing comfort can itself provide a type of meaning, though deep down, we know we’re not meant for perpetual ease. Investing, even when not strictly necessary, can be about creating a meaningful struggle, and finding purpose by placing your resource at risk. On the other hand, too much action without a chance of ever ‘arriving’ is equally dangerous.

______________________

Online courses:

The Home Buyers Blueprint: Get a better home; Get a better mortgage.

The KiwiSaver Millionaire Roadmap: From 6 figures to 7; Get a Rockstar Retirement!

New Wealth Foundations: Personal finance from a wealth-builder’s perspective.

Take the free, 5-part online course Crypto 101: Crypto with Confidence (In partnership with Easy Crypto)

Book in a free 15-min phone call with Darcy Ungaro (financial adviser)- click on this link.

Get Social

Check out the most watched/downloaded episodes here

Follow on YouTube , Instagram, TikTok: @theeverydayinvestor, X (@UngaroDarcy), LinkedIn.

Learn more about Ungaro & Co Financial Advice: www.ungaro.co.nz

________________________

Affiliate Links!

I may receive a financial benefit if you click on these links.

Sharesight: (Get 5 months free)

Revolut: Sign up and get a $15 credit.

Disclaimer: Please act independently from any content provided in these episodes; it’s not financial advice, because there’s no accounting for your individual circumstances. Do your own research and take a broad range of opinions into account. Ideally, engage a financial adviser and pay for advice!

Listen to NZ Everyday Investor Podcast:

Staring into the Abyss – James Hughes, Tonkin + Taylor

James Hughes looks into the future and tells New Zealand’s councils just how bad life could get as a result of climate change. James, technical director for climate and resilience for engineering consultancy Tonkin + Taylor, performs climate risk assessments. You could call it staring into the abyss; he tells Ross Inglis it’s often the starting point for difficult conversations about the impacts of global warming.

Listen to the Podcast Here:

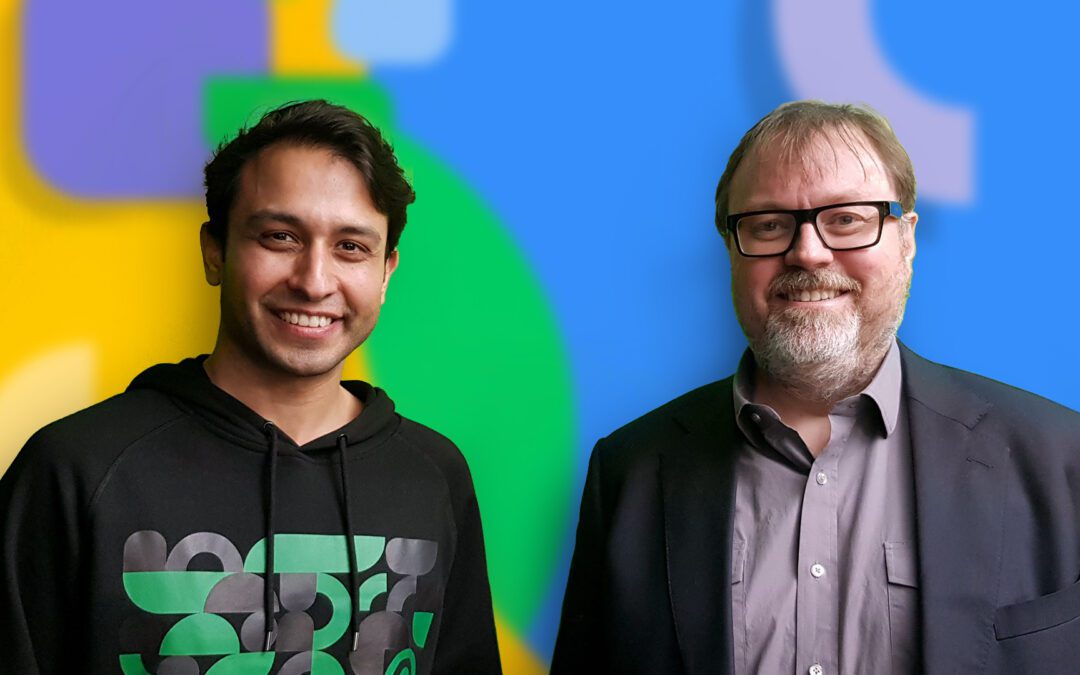

Digital Banks vs Incumbents + Governments vs Social Media

Join host Paul Spain and Sulabh Sharma, Co-Founder at Debut NZ, as they explore the dynamic world of fintech and the rise of digital banking in New Zealand, also discussed is the broader implications of government intervention in social media.

Plus, Tech news from the week including:

- New Zealand’s ‘right to repair’ movement

- Amazon’s latest Alexa updates

- Meta’s COVID-19 censorship under Biden administration

- Brazil’s first days without X

- Couple sues over AI voice cloning

Special thanks to our show partners: One NZ, 2degrees, Spark NZ, HP, and Gorilla Technology.

Home Equity Retirement, Ep 433 / Ralph Stewart

Today I’m speaking with the one and only Ralph Stewart. Ralph is the Founder and Managing Director of Lifetime Retirement Income, a business with over $1b in funds under management. He’s a former CEO of AXA Insurance and the Accident Compensation Corporation (ACC). Ralph’s a smart cookie, and he’s on a mission trying to free the equity-rich cash poor prisoners out there.

Book in a free 15-min phone call with Darcy Ungaro (financial adviser)- click on this link.

________________

The Home Buyers Blueprint: Get a better home; Get a better mortgage.

The KiwiSaver Millionaire Roadmap: From 6 figures to 7; Get a Rockstar Retirement!

New Wealth Foundations: Personal finance from a wealth-builder’s perspective.

Take the free, 5-part online course Crypto 101: Crypto with Confidence (In partnership with Easy Crypto)

Get Social

Check out the most watched/downloaded episodes here

Follow on YouTube , Instagram, TikTok: @theeverydayinvestor, X (@UngaroDarcy), LinkedIn.

Learn more about Ungaro & Co Financial Advice: www.ungaro.co.nz

________________________

Affiliate Links!

I may receive a financial benefit if you click on these links.

Sharesight: (Get 5 months free)

Revolut: Sign up and get a $15 credit.

Disclaimer: Please act independently from any content provided in these episodes; it’s not financial advice, because there’s no accounting for your individual circumstances. Do your own research and take a broad range of opinions into account. Ideally, engage a financial adviser and pay for advice!

Listen to NZ Everyday Investor Podcast:

Sunny Days for Solar – Jason Foden, Rānui Generation

Solar developer Rānui Generation started ground works the Twin Rivers Solar Farm, near Kaitaia. The 31MWp project could power 6,000 households or 25,000 electric vehicles for a year – and it’s the first of four solar farms planned around the country. To talk about the project and what role solar will play in our energy future, Vincent was joined by the CEO Jason Foden.

Listen to the Podcast Here:

Self-Paying Mortgages & Engineered Money, Ep 432 / CJ Konstantinos

I know that I can’t predict the future, but I can see something coming to how our money works. A lot of people can. The signs are getting pretty obvious – there are significant changes afoot which may affect how, and if, you can access the future wealth you’re building up today.

This idea may be confronting, but at some stage, a financial authority may want more of a say in how you spend your money. If that idea bothers you, then I’d invite you to pay attention to today’s episode. Read more

Check out @cjkonstantinos on X and on YouTube for more.

Take the free, 5-part online course Crypto 101: Crypto with Confidence.

________________

The Home Buyers Blueprint: Get a better home; Get a better mortgage.

The KiwiSaver Millionaire Roadmap: From 6 figures to 7; Get a Rockstar Retirement!

New Wealth Foundations: Personal finance from a wealth-builder’s perspective.

Book in a free 15-min phone call with Darcy Ungaro (financial adviser)– click on this link.

Get Social

Check out the most watched/downloaded episodes here

Follow on YouTube , Instagram, TikTok: @theeverydayinvestor, X (@UngaroDarcy), LinkedIn.

Learn more about Ungaro & Co Financial Advice: www.ungaro.co.nz

________________________

Affiliate Links!

I may receive a financial benefit if you click on these links.

Sharesight: (Get 5 months free)

Revolut: Sign up and get a $15 credit.

Disclaimer: Please act independently from any content provided in these episodes; it’s not financial advice, because there’s no accounting for your individual circumstances. Do your own research and take a broad range of opinions into account. Ideally, engage a financial adviser and pay for advice!

Listen to NZ Everyday Investor Podcast:

Andrew Young: CEO, NZ Cancer Society Auckland Northland division

Andrew Young, Chief Executive of the Cancer Society’s Auckland Northland division join’s Paul Spain to discuss his learnings over 20 years of leadership and governance in the business and charity sector. Andrew shares his journey, driven by personal loss and a commitment to reducing cancer’s impact. Listen and learn from a key New Zealand leader, plus support Daffodil Day and the fight against cancer.

Donate at Daffodil Day 2024

Listen to the Podcast Here:

Gorilla Technology

Paul Spain – LinkedIn

Paul Spain – CEO, Business & Tech Commentator, Futurist

You can keep current with our latest NZ Business Podcast updates via Twitter @NZ_Business, the NZ Business Podcast website.

Rocket Lab’s Rise, Genetic Engineering in NZ, and AI’s Impact on Music

Join Paul Spain and Josh Webb (HYPR NZ) as they delve into the latest tech news. They celebrate Uber’s 10-year milestone in New Zealand, discuss the implications of lifting the genetic engineering ban, and examine AI’s impact on the music industry. The conversation also highlights Rocket Lab’s impressive achievements, the end of an era for Fitbit, the introduction of Direct to Cell Satellite coverage in New Zealand and more.

Special thanks to our show partners: One NZ, 2degrees, Spark NZ, HP, and Gorilla Technology.

Property: Is The Fuse Now Lit? Ep 431 / Nolan Matthias

The recent drop in the official cash rate (OCR) by 0.25% has sparked a flurry of speculation about the future of the property market. Those hanging on for dear life are desperate for good news and recency bias is at work here – many believe lower interest rates signal a return to the boom times. However high on hopium property hodlers are, reality is a bit more nuanced. Read more

Check out the Nolan Matthias YouTube channel

_________________

Take The Home Buyers Blueprint: Get a better home; Get a better mortgage.

Sign up to the KiwiSaver Millionaire Roadmap: From 6 figures to 7; Get a Rockstar Retirement!

Sign up to New Wealth Foundations here: Personal finance from a wealth-builder’s perspective.

Take the free, 5-part online course Crypto 101: Crypto with Confidence.

Thanks to Easy Crypto, New Zealand’s most trusted crypto brand and what Darcy Ungaro uses.

Book in a free 15-min phone call with Darcy Ungaro (financial adviser)– click on this link.

Get Social

TikTok: @theeverydayinvestor

Darcy Ungaro

Twitter: @UngaroDarcy

________________________

Affiliate Links!

I may receive a financial benefit if you click on these links.

Sharesight: (Get 5 months free)

Revolut: Sign up and get a $15 credit.

Disclaimer: Please act independently from any content provided in these episodes; it’s not financial advice, because there’s no accounting for your individual circumstances. Do your own research and take a broad range of opinions into account. Ideally, engage a financial adviser and pay for advice!

Listen to NZ Everyday Investor Podcast:

NZ Under Surveillance plus AI enable devices from Samsung and HP

In this episode, host Paul Spain and guest Bill Bennett look into the rise of AI surveillance and its impact on New Zealand society. They discuss the impact of Huawei’s exit from the New Zealand telecommunications market and the implications of the deployment of AI cameras on New Zealand buses for road safety. Plus, hands on with AI tech: HP OmniBook, Samsung Z Fold and more.

The surveilled society: Who is watching you and how | RNZ News

Special thanks to our show partners: One NZ, 2degrees, Spark NZ, HP, and Gorilla Technology.

The REAL Values-Based Investment Strategy, Ep 430 / Hayden Brown

It’s not about the tools; it’s about the person using them. You’re the tool. What’s the point of obsessing over the best investments if you can’t handle it when things go wrong? Read more.

_________________

Take The Home Buyers Blueprint: Get a better home; Get a better mortgage.

Sign up to the KiwiSaver Millionaire Roadmap: From 6 figures to 7; Get a Rockstar Retirement!

Sign up to New Wealth Foundations here: Personal finance from a wealth-builder’s perspective.

Thanks to Easy Crypto, New Zealand’s most trusted crypto brand and what Darcy Ungaro uses.

Book in a free 15-min phone call with Darcy Ungaro (financial adviser)– click on this link.

Get Social

TikTok: @theeverydayinvestor

Darcy Ungaro

Twitter: @UngaroDarcy

________________________

Affiliate Links!

I may receive a financial benefit if you click on these links.

Sharesight: (Get 5 months free)

Revolut: Sign up and get a $15 credit.

Disclaimer: Please act independently from any content provided in these episodes; it’s not financial advice, because there’s no accounting for your individual circumstances. Do your own research and take a broad range of opinions into account. Ideally, engage a financial adviser and pay for advice!

Listen to NZ Everyday Investor Podcast:

Steven Moe, purpose-driven lawyer and quiet revolutionary

You might know Steven Moe as a lawyer for Christchurch based Parry Field, specialising in charities and the impact sector; or as the chair of Community Finance – an investor in community housing; or as the host of Seeds, a longstanding weekly podcast; or as the author of The Apple Tree, or as a mentor for Christchurch incubator Ministry of Awesome or a quietly spoken father and friend. However you know him, Steven’s seems to crop up everywhere there are sustainable causes or purpose-led businesses. Vincent chats to a quiet revolutionary at work.

Apple Tree Book https://theseeds.nz/books/the-apple-tree/

Seeds Podcast www.theseeds.nz

Legal opinion on impact investing https://www.parryfield.com/impact-investing-information-hub/

Listen to the Podcast Here: