Making the keto lifestyle easy

Julie Gillingham was a dental hygienist when she fell in love with the keto lifestyle. After giving birth to two children, she loved how keto made her feel. The sleep was better, she had more energy and of course, the weight loss was a bonus. She did miss eating ice cream though. And pizza!

“When my family was following keto strictly, we would have pizza once a week but could never find a pizza base that was both tasty and affordable.” So she decided to try making them herself. Julie had hit on the right pain point because anyone doing keto knows that giving up bread is the hardest bit. Not because of its doughy goodness but rather because you need a ‘base’ for the food you cook or to mop up that curry.

Julie eventually traded in her mask and scrubs for an apron & chefs cap to pursue her dream of running and growing Keto Smart Bakes full time. The range of products she offers has continued to expand from pizza bases to bagels, tortillas and garlic bread, with more to come!

The unique thing about Keto Smart Bakes is that everything is made in small batches, hand-crafted and freshly baked weekly. “I work on a pre-order basis and that can be a bit challenging for new customers because we live in such an instantaneous world. But my customers know that I am a solopreneur and that I’m also a mom. They know that I put so much into my business and my products that it’s worth the wait.”

Specifically, we chat about:

- As a small business owner, finding the balance between work life and home life

- Working around production challenges when everything is hand-crafted

- Making ‘convenience’ products that are still worth the wait

Listen to the Podcast Here:

Favourite quotes:

“I’ve had people come and ask me are you even a business because every time they try to pre-order we have already sold out.”

“I was creating the things that people were missing. BLT’s, pizza, bagels, people miss eating those on keto and they don’t always enjoy baking those themselves. If you can buy these products then it makes eating keto easier.”

“People keep coming back because of the quality. Everything is made in small batches. I hand roll the bagels. I’m not a huge factory but rather one person that’s trying to make a difference.”

News of The Money-World / Ep 8 / Investing in TLA’s

Welcome to a short bonus series in addition to our weekly show. In partnership with Koura Wealth, your digital KiwiSaver provider, The NZ Everyday Investor is proud to present, News of The Money-World, a short, fortnightly show, about what’s happening in the finance world and how that affects you, the everyday Kiwi.

TLA’s, or three letter acronyms: a subconscious moat of defense we collectively lay down when we need to own the support of others. In your profession, your circle of friends, your flavor of politics, you’ll have your own language, and you may not even know you’re excluding others by default. The finance industry does this also – so today, we’re going to break some of them down and discuss what we think they mean

Rupert Carlyon from koura wealth KiwiSaver is my co-host, along with Tom Botica, from Investing with Tom.

Julian McCormack, Ep 160, Know the Ledge

‘Living on shaky grounds too close to the edge, let’s see if I know the ledge’ – Eric B and Rakim. We’re having a discussion today around the share markets, inflation, trends, and how to think about investing with the level of caution required for today’s world.

My guest today: Julian McCormack from Platinum Asset Management

Building wealth is about owning the right to have choice in the future – choices for you and for what’s important to you. Investing, or the practice of putting skin in a game where the odds are increasingly stacked in your favour over time, can often invoke emotions in us that we mistakenly thought we’ve already mastered. When the rubber hits the road and your hard-earned dollars are invested, logically, you want to understand the environment in which your dollars are at play in.

This environment is in a constant state of change. So today, let’s talk about that – enjoy!

Disclaimer: Platinum Investment Management Limited ABN 25 063 565 006, AFSL 221935, trading as Platinum Asset Management: Commentary reflects Platinum’s views and beliefs at the time of recording, which are subject to change without notice. Certain information contained herein constitutes “forward-looking statements”. Due to various risks and uncertainties, actual events or results, may differ materially and no undue reliance should be placed on those forward-looking statements. To the extent permitted by law, no liability is accepted by Platinum for any loss or damage as a result of any reliance on the information contained herein. Information is general in nature and does not take into account your specific needs or circumstances. You should consider your own financial position, objectives and requirements and seek professional financial advice before making any financial decisions. You should also read the latest relevant product disclosure statement before making any decision to acquire units in any of Platinum’s funds, copies are available at www.platinum.com.au

The NZ Everyday Investor is brought to you in partnership with Hatch. Hatch, let’s you become a shareholder in the world’s biggest companies and funds. We’re talking about Apple and Zoom, Vanguard and Blackrock.

So, if you’re listening in right now and have thought about investing in the US share markets, well, Hatch has given us a special offer just for you… they’ll give you a $20 NZD top-up when you make an initial deposit into your Hatch account of $100NZD or more.

Just go to https://hatch.as/NZEverydayInvestor to grab your top up.

____________________________________________________________

Like what you’ve heard?

You can really help with the success of the NZ Everyday Investor by doing the following:

1- Follow @darcyungaro on Clubhouse.

2- Write a review on Facebook, or on your favourite podcast player

3- Help support the mission of our show on Patreon by contributing here

4- To catch the live episodes, please ensure you have subscribed to us on Youtube:

5- Sign up to our newsletter here

NZ Everyday Investor is on a mission to increase financial literacy and make investing more accessible for the everyday person!

Please ensure that you act independently from any of the content provided in these episodes – it should not be considered personalised financial advice for you. This means, you should either do your own research taking on board a broad range of opinions, or ideally, consult and engage a financial adviser to provide guidance around your specific goals and objectives.

If you would like to enquire around working with Darcy (financial adviser), you can schedule in a free 15 min conversation just click on this link

_____________________________________________________________________________

News of The Money-World / Ep 7 / RBNZ Playing Chicken with Inflation?

Welcome to a short bonus series in addition to our weekly show. In partnership with Koura Wealth, your digital KiwiSaver provider, The NZ Everyday Investor is proud to present, News of The Money-World, a short, weekly show, about what’s happening in the finance world and how that affects you, the everyday Kiwi.

Has inflation arrived in earnest, has it moved in, or is it that one friend who visits from time to time simply to burp in the fan on a hot day?

It’s an odd world we live in where the enemy of the economy, inflation, is being pursued like a purse- snatcher down a dark alley. You really don’t want to catch it, but you feel a perverse need to chase and obtain what you’ve likely lost ages ago.

More and more of us are starting to believe inflation is here however. Oddly, the more people think it’s here, the more likely it could get worse – perhaps we should label inflation-talk as hate speech to be safe?

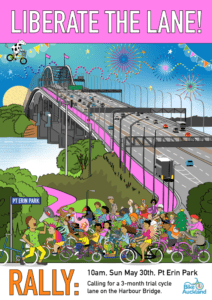

#Liberatethelane! The Auckland Harbour Bridge Protest with David & Mary-Margaret Slack

Last Sunday a remarkable thing happened. Along with 2000 of my best friends I rode over the Auckland harbour bridge on my bicycle. I was surpirsed how gentle the gradient was and how pitted the tar-seal surface is. The views are some of the best in Auckland. The really surprising thing though is that were doing it all. The last time someone rode over the bridge is 12 years ago – also a protest at the lack of cycling access to the shore. 12 years later we still have nothing on offer excpet crowded ferries. The situation so riled my next guests that they decided to act, creating – along with BikeAuckland – the Reclaimthelane rally and protest. I’m joined by Mary-Margaret Slack, a comms manager at BikeAuckland and her dad, David Slack, writer and inveterate cycling enthusiast.

Hear the Podcast Here:

See more about LiberateTheLane here

See the lovely picture of Mary-Margaret at the 2009 protest in David’s superb article here

Check out here this amazing climb-down from anti-cycling objectors in Vancouver when a bike lane was introduced to their harbour bridge. They now want two!

BE CYBER CONFIDENT. BE CYBER SECURE WITH MATTHEW EVETTS (DATACOM) AND SEAN DUCA (PALO ALTO NETWORKS)

Need to get that Cyber confident feeling back after the hard-hit of Covid-19?

Join industry experts as they dive deep into the way organisations manage the impact cyber-confidence can have in the digital age.

This episode covers:

- COVID-19 pandemic brought into stark light the perils of unmanaged cyber-risk

- Attention on Cyber-wellness

- Impacts technology debt cybersecurity

Cybersecurity is a shared responsibility – the more systems we secure, the more secure all are.

Paul Spain is joined by Sean Duca (Vice President and Regional Chief Security Officer for Asia Pacific – Palo Alto Networks) and Matthew Evetts (Director Cybersecurity, Datacom) on this NZ Tech Podcast episode.

Special thanks to organisations who support innovation and tech leadership in New Zealand by partnering with NZ Tech Podcast:

Umbrellar Connect

Vodafone NZ

HP

Spark NZ

Vocus

Gorilla Cyber Security

Datacom

Palo Alto Networks

NZ Sales & Marketing Insider – Episode 10: Nathan James

Ben catches up with Renaissance ad man and Icebreaker Creative Director Nathan James on an incredible career and what he’s learned along the way. As a creative and producer, Nathan’s worked at some incredible creative agencies in London, Amsterdam, Stockholm and Auckland on powerbrands including Nike, Budweiser, IKEA, Coca Cola and many, many others. He’s also found time to keep on learning new skills and is a film maker, DJ and (allegedly) marine mammal medic! This chat runs the full gamut and is full of insightful tips.

Listen or Subscribe Free:

What’s a Woman Supposed to Do?

Kaye Maxwell was one of New Zealand’s top amateur golfers whose feminist outlook got her in trouble with golf administrators when she refuse to conform to the party line—whatever that was at the time. She quit New Zealand and headed overseas where she played and in time moved back to South Auckland, turned professional at a late age for teaching purposes, bought a farm, and converted it into a 9-hole course for women.

Listen now:

What’s Up at Gulf Harbour?

Gulf Harbour Country Club, site of the 1998 World Cup of Golf, and one of the most scenic courses in New Zealand, has been up and down. At one stage, members were forced to buy the club off its discredited owner. Our hosts talk with current Director of Golf, Frazer Bond, to find out where things are at today.

Listen now:

Warren Couillault / Bridging the Advice-Gap / Ep 158

A recent survey in the UK indicated around 30% of financial advisers will be retiring before 2025, a further 1/3 will be exiting in the next 10 yrs – so 6 out of 10 will be gone in the next decade. A survey from financial advice NZ conducted in 2020 showed that just over 50% of advised Kiwis say they are at least reasonably prepared for retirement compared to 26.4% of unadvised people.

So – less financial advisers, but clearly a better result occurs as a result of financial advice.

Digital advice, advice-only advisers, and decentralised finance will help create better outcomes for consumers of financial advice…eventually. Now though, those with smaller sums to invest, often don’t receive the same level of advice or service as those with higher amounts – why? Because in most cases, the fees you pay are a % of the amount that’s being invested on your behalf. There’s a lot of work and compliance costs involved in providing personalised financial advice, so this is why it’s mostly only efficient to provide advice for those who already have wealth, not those who are at the earlier stages of accumulation.

I caught up with today’s guest Warren Couillault, from Hobson Wealth, because I wanted to learn of the innovation that’s occurred and is occurring in the financial advice space.

Regulators, industry bodies, wealth managers, KiwiSaver providers, and financial advisers – all have a part to play to ensure financial advice is delivered to more Kiwi’s, irrespective of any competing agendas. If anything takes away from this goal, you need to question why, especially considering the outcomes of receiving advice are so positive.

_____________________________________________________________

The NZ Everyday Investor is brought to you in partnership with Hatch. Hatch, let’s you become a shareholder in the world’s biggest companies and funds. We’re talking about Apple and Zoom, Vanguard and Blackrock.

So, if you’re listening in right now and have thought about investing in the US share markets, well, Hatch has given us a special offer just for you… they’ll give you a $20 NZD top-up when you make an initial deposit into your Hatch account of $100NZD or more.

Just go to https://hatch.as/NZEverydayInvestor to grab your top up.

__________________________________________________________________

Like what you’ve heard?

You can really help with the success of the NZ Everyday Investor by doing the following:

1- Follow the NZ Everyday Investor on Clubhouse. This link also serves as an invite to the platform.

2- Write a review on Facebook, or your favourite podcast player

3- Help support the mission of our show on Patreon by contributing here

4- To catch the live episodes, please ensure you have subscribed to us on Youtube:

5- Sign up to our newsletter here

6-Tell your friends!

NZ Everyday Investor is on a mission to increase financial literacy and make investing more accessible for the everyday person!

Please ensure that you act independently from any of the content provided in these episodes – it should not be considered personalised financial advice for you. This means, you should either do your own research taking on board a broad range of opinions, or ideally, consult and engage a financial adviser to provide guidance around your specific goals and objectives.

If you would like to enquire around working with Darcy (financial adviser), you can schedule in a free 15 min conversation just click on this link

News of The Money-World / Ep 6 / Gambling, or Investing, in Bitcoin?

Welcome to a short bonus series in addition to our weekly show. In partnership with Koura Wealth, your digital KiwiSaver provider, The NZ Everyday Investor is proud to present, News of The Money-World, a short, weekly show, about what’s happening in the finance world and how that affects you, the everyday Kiwi.

Bitcoin is an emerging new asset class desperately seeking validation in the eyes of the mainstream financial community…or perhaps it doesn’t actually care at all. Perhaps with crypto in general, it is what it is, but what it does to us, is more than most of us are ready for (myself included!)

Today, Rupert and I discuss the tensions between the ‘already’ and the ‘not yet’. Bitcoin, and the neighbourhood in which it comes from, has the very real potential of flattening the status quo given enough time – this is a war make no mistake. However, the winners today, could be the losers tomorrow – Enjoy the show!

Teaching 50,000 Kiwis how to cook Asian food

Sachie Nomura came to New Zealand after graduating high school, mainly to speak English. What was she most surprised with on coming here? She says, “I was surprised with the size…not of the country but with the size of vegetables here. In Japan, a capsicum may be the size of an egg while here it’s more like an apple!”

Sachie’s journey in entrepreneurship started rather serendipitously while she was working in hospitality sales. She went in one morning and learned of a colleague that had passed away from a heart attack at just 45. That same afternoon she heard of another friend that also passed away. “It was a lightbulb moment. If I die tomorrow, will I have any regrets? I went back home and drew a mind map. What do I love – food, what do I enjoy doing – I love cooking and sitting with others to eat, what skills did I have – I know how to cook Asian food really well. So I thought, that’s it. I will teach those who love Asian food how to cook it. It’s in my kitchen so I will call it Sachie’s kitchen and so it began.”

It has now been ten years since that day and Sachie’s Kitchen has gone from strength to strength. It is now one of the most-awarded cooking schools in Australasia. To date, more than 50,000 New Zealanders have been through Sachie’s Kitchen with millions more watching her demonstrations on the small screen – her television show is broadcast in over 35 countries.

Her classes appeal to individuals with a passion for Asian cooking and also corporate teams who book events that cover Japanese, Thai, Vietnamese, Malaysian, Chinese, Indian & Korean cuisine. Sachie has gone on to launch her own range of branded food products nationwide and is now exploring virtual cooking classes as well.

Listen to the Podcast Here:

Favourite quotes:

Growing up for me, food = people

When I opened the door to Sachie’s kitchen in Parnell I had to really think of how people would find me and know about my kitchen. For me, the answer was media. So, I wrote it down on my mind map. I wrote TV, radio, magazine. And the law of attraction took over. When I write things, it attracts opportunities in my life. Over the next two weeks, my husband bumped into someone that ran a radio station and I got onto the radio. Same for my TV show, I wrote it down and then one day, the producer came through the door.

Opportunities are always around you. They are ready, for anyone to grab. But if you’re not ready, you will not see them. You will miss the boat.

In front of my computer, I have a wall where I have a mind map. I write on it opportunities I want to attract, where I want to be and then I transfer it into my yearly calendar and then it does just happen.