Empowering Kiwi Innovation: How can Microsoft help lift our future with Microsoft’s Vanessa Sorenson

Host Paul Spain is joined by Vanessa Sorenson, head of Microsoft NZ and Chief Partner Officer ANZ, as they discuss the evolving New Zealand tech landscape and Microsoft’s role, including local data centre developments, and the advancements and integration of AI technology, Plus Microsoft NZ and Straker collaborate to develop full Te Reo Maori translation for digital content. Listen to this in-depth conversation and discover the opportunities, challenges, and innovations from Microsoft New Zealand.

Listen to NZ Tech Podcast:

One NZ ,HP ,Spark NZ ,2degrees ,Gorilla Technology

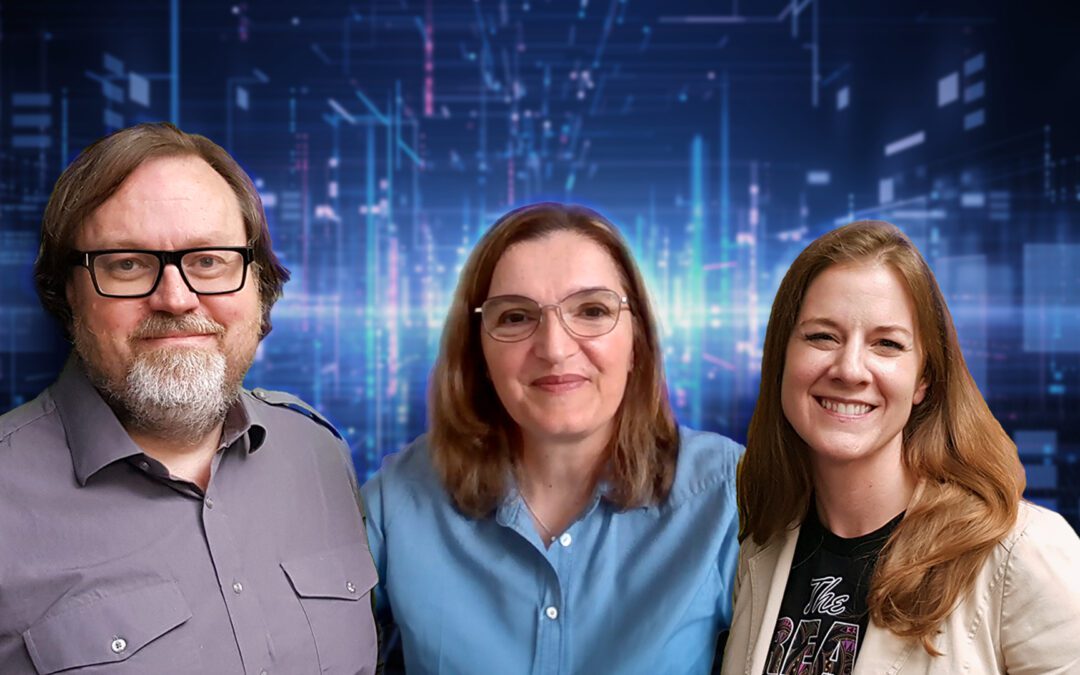

Disinformation exposed – Byron Clark and Mandy Henk

Whether it’s swallowing bleach to treat Covid or casting climate change as a Chinese conspiracy, disinformation takes nutty ideas from fringes and mainstreams them into our popular discourse. At best, it’s hilarious – seen how windmills kill dolphins anyone? But mostly it’s just sad and sometimes tragic.

What is disinformation? How is it different from misinformation? Who are the main perpetrators and the victims? No one knows more about this than Byron Clark, author of ‘Fear: New Zealand’s Hostile Underworld of Extremists’ and Mandy Henk an advocate for healthy, just, and vibrant digital communities.

Together they are offering a Climate Disinformation Night Class, consisting of eight-week, Zoom-based sessions via Tohatoha, an organisation creating a fairer digital world.

Listen to the Podcast Here:

Watching Cycles and Sentiment: Gary Savage Ep 410

Check out Smart Money Tracker by Gary Savage.

The more I learn about how people actually build wealth, the more cautiously I prescribe diversification.

We’re sold index funds, but businesses and property are often what really move the needle.

_________________

Take The Home Buyers Blueprint: Get a better home; Get a better mortgage.

Sign up to the KiwiSaver Millionaire Roadmap: This one’s free!

Sign up to New Wealth Foundations here: Personal finance from a wealth-builder’s perspective.

Thanks to Easy Crypto, New Zealand’s most trusted crypto brand and what Darcy Ungaro uses.

Book in a free 15-min phone call with Darcy Ungaro (financial adviser)– click on this link.

Get Social

TikTok: @theeverydayinvestor

Darcy Ungaro

Twitter: @UngaroDarcy

________________________

Affiliate Links!

I may receive a financial benefit if you click on these links.

Sharesight: (Get 5 months free)

Revolut: Sign up, and get a $15 credit.

Disclaimer: Please act independently from any content provided in these episodes; it’s not financial advice, because there’s no accounting for your individual circumstances. Do your own research, and take a broad range of opinions into account. Ideally, engage a financial adviser and pay for advice!

Listen to NZ Everyday Investor Podcast:

AWS Investment in New Zealand’s Tech Future

Host Paul Spain is joined by Tiffany Bloomquist and Rada Stanic from Amazon Web Services (AWS), as they delve into the transformative power of AI services for businesses and leveraging machine learning and the impact of cloud migration. They also explore real-world examples and future opportunities for NZ’s tech sector. Discover how AWS is investing in infrastructure, skills, and community programs to empower individuals and organisations.

Listen to NZ Tech Podcast:

One NZ ,HP ,Spark NZ ,2degrees ,Gorilla Technology

How to Get Rich: The Financial Strategy, Ep 409 Darcy Ungaro

Find out about our financial strategy sessions

I want you to imagine a black box – Imagine wrapping up some of your time, and some of your money and just chucking it in that box. We believe that by doing so, we’ll get out more than what we put in. Our labour and/or our capital, perhaps a bit of both. Das Kapital, or Wealth of Nations? Read more.

_________________

Take The Home Buyers Blueprint: Get a better home; Get a better mortgage.

Sign up to the KiwiSaver Millionaire Roadmap: This one’s free!

Sign up to New Wealth Foundations here: Personal finance from a wealth-builder’s perspective.

Thanks to Easy Crypto, New Zealand’s most trusted crypto brand and what Darcy Ungaro uses.

Book in a free 15-min phone call with Darcy Ungaro (financial adviser)– click on this link.

Get Social

TikTok: @theeverydayinvestor

Darcy Ungaro

Twitter: @UngaroDarcy

________________________

Affiliate Links!

I may receive a financial benefit if you click on these links.

Sharesight: (Get 5 months free)

Revolut: Sign up, and get a $15 credit.

Disclaimer: Please act independently from any content provided in these episodes; it’s not financial advice, because there’s no accounting for your individual circumstances. Do your own research, and take a broad range of opinions into account. Ideally, engage a financial adviser and pay for advice!

Listen to NZ Everyday Investor Podcast:

A Sustainable Commute at a Discount – Connor Read, Workride

If you’ve wanted to get yourself a discounted bicycle or scooter under something like the UK’s Cycle to Work Scheme, here’s the good news: you can. Ōtautahi Christchurch-based WorkRide now offers a national ride-to-work scheme that uses a Fringe Benefit Tax exemption to slice up to 63 percent off the cost of your next commuter toy.

Ross Inglis asked co-founder Connor Read how the scheme works.

Listen to the Podcast Here:

Clive Thompson Pt 2: CBDC’s & Debt Jubilee Ep 407

In today’s show, you’ll learn how the future could be more than a little good. That’s right, all that cray cray crazy in the world is actually a good sign.

Clive Thompson is a retired private banker and wealth manager of 47 years, based in Switzerland. None of this is financial advice, but I do hope it gets you thinking!

_________________

Take The Home Buyers Blueprint: Get a better home; Get a better mortgage.

Sign up to the KiwiSaver Millionaire Roadmap: This one’s free!

Sign up to New Wealth Foundations here: Personal finance from a wealth-builder’s perspective.

Thanks to Easy Crypto, New Zealand’s most trusted crypto brand and what Darcy Ungaro uses.

Book in a free 15-min phone call with Darcy Ungaro (financial adviser)– click on this link.

Get Social

TikTok: @theeverydayinvestor

Darcy Ungaro

Twitter: @UngaroDarcy

________________________

Affiliate Links!

I may receive a financial benefit if you click on these links.

Sharesight: (Get 5 months free)

Revolut: Sign up, and get a $15 credit.

Disclaimer: Please act independently from any content provided in these episodes; it’s not financial advice, because there’s no accounting for your individual circumstances. Do your own research, and take a broad range of opinions into account. Ideally, engage a financial adviser and pay for advice!

Listen to NZ Everyday Investor Podcast:

Leap Year glitches, Apple EV scrapped, AI Quirks and more

In this Tech News edition host Paul Spain is joined Darcy Ungaro (Ungaro & Co.) as they explore some of the latest happenings including:

- Leap year glitch breaks NZ pay-at-the pumps

- Gemini AI’s inaccuracies

- Amazon’s Auckland building delayed

- Spark’s new AI training programme

- State-sponsored hacking

- Apple scraps EV car

- Latest M3 MacBook Air and how MacBooks are beating Windows best laptops

Listen to NZ Tech Podcast:

One NZ ,HP ,Spark NZ ,2degrees ,Gorilla Technology

Clive Thompson: How to Invest Through a Currency Reset, Ep 406

Check out YouTube Version Here.

Clive Thompson is a retired private banker and wealth manager, now living on the shores of Lake Geneva, Switzerland, after a career spanning 47 years.

Book in a free 15-min phone call with Darcy Ungaro (financial adviser)– click on this link.

_________________

Take The Home Buyers Blueprint: Get a better home; Get a better mortgage.

Sign up to the KiwiSaver Millionaire Roadmap: This one’s free!

Sign up to New Wealth Foundations here: Personal finance from a wealth-builder’s perspective.

Thanks to Easy Crypto, New Zealand’s most trusted crypto brand and what Darcy Ungaro uses.

Get Social

TikTok: @theeverydayinvestor

Darcy Ungaro

Twitter: @UngaroDarcy

________________________

Affiliate Links!

I may receive a financial benefit if you click on these links.

Sharesight: (Get 5 months free)

Revolut: Sign up, and get a $15 credit.

Disclaimer: Please act independently from any content provided in these episodes; it’s not financial advice, because there’s no accounting for your individual circumstances. Do your own research, and take a broad range of opinions into account. Ideally, engage a financial adviser and pay for advice!

Listen to NZ Everyday Investor Podcast:

Sam Wood – How a non-geek built a tech enabled health and fitness empire

Join Paul Spain as he sits down with Sam Wood for an insightful conversation about fitness, technology, and entrepreneurship! Sam shares his journey of building 28 By Sam Wood, an online fitness and nutrition program, and how technology has played a pivotal role in the success of the business.

Listen to NZ Tech Podcast:

One NZ ,HP ,Spark NZ ,2degrees ,Gorilla Technology

Bridget Jackson: When it Ends in Divorce, Ep 405

When you borrow money, own a home, have kids, or even just enjoy the same group of friends, often your connection to it is via a partnership. You’re jointly and severally entangled into all you know, love, and value.

If it all falls apart, wouldn’t it be good to know the art in how you build back up again? Read More

Bridget Jackson is a divorce coach and she heads up Equal Exes.

_________________

Take The Home Buyers Blueprint: Get a better home; Get a better mortgage.

Sign up to the KiwiSaver Millionaire Roadmap: This one’s free!

Sign up to New Wealth Foundations here: Personal finance from a wealth-builder’s perspective.

Thanks to Easy Crypto, New Zealand’s most trusted crypto brand and what Darcy Ungaro uses.

Book in a free 15-min phone call with Darcy Ungaro (financial adviser)– click on this link.

Get Social

TikTok: @theeverydayinvestor

Darcy Ungaro

Twitter: @UngaroDarcy

________________________

Affiliate Links!

I may receive a financial benefit if you click on these links.

Sharesight: (Get 5 months free)

Revolut: Sign up, and get a $15 credit.

Disclaimer: Please act independently from any content provided in these episodes; it’s not financial advice, because there’s no accounting for your individual circumstances. Do your own research, and take a broad range of opinions into account. Ideally, engage a financial adviser and pay for advice!

Listen to NZ Everyday Investor Podcast:

How to change carbon behaviour, big time – Ben Gleisner, Cogo

The conscious consumer movement has an impact but it’s still small – a minority of people choose to change their behaviour. Imagine if you could make your carbon footprint your bank’s problem. Imagine these large institutions, with millions of customers and insights into their spending, worry about their customers’ carbon footprint. That’s the genius of new carbon disclosure laws – banks, insurances companies, airlines and other large companies must now report not only on their own footprints but their customers’ too – so-called Scope 3 emissions. And someone needs to help them do that counting.

Enter Cogo, formerly a personal carbon footprint app, now being deployed by banks across Australia, NZ and the UK. Ben Gleisner, founder and entrepreneur joins Vincent to explain what’s going on with Cogo.

Listen to the Podcast Here: